Trigger Warning: Chart of the Day

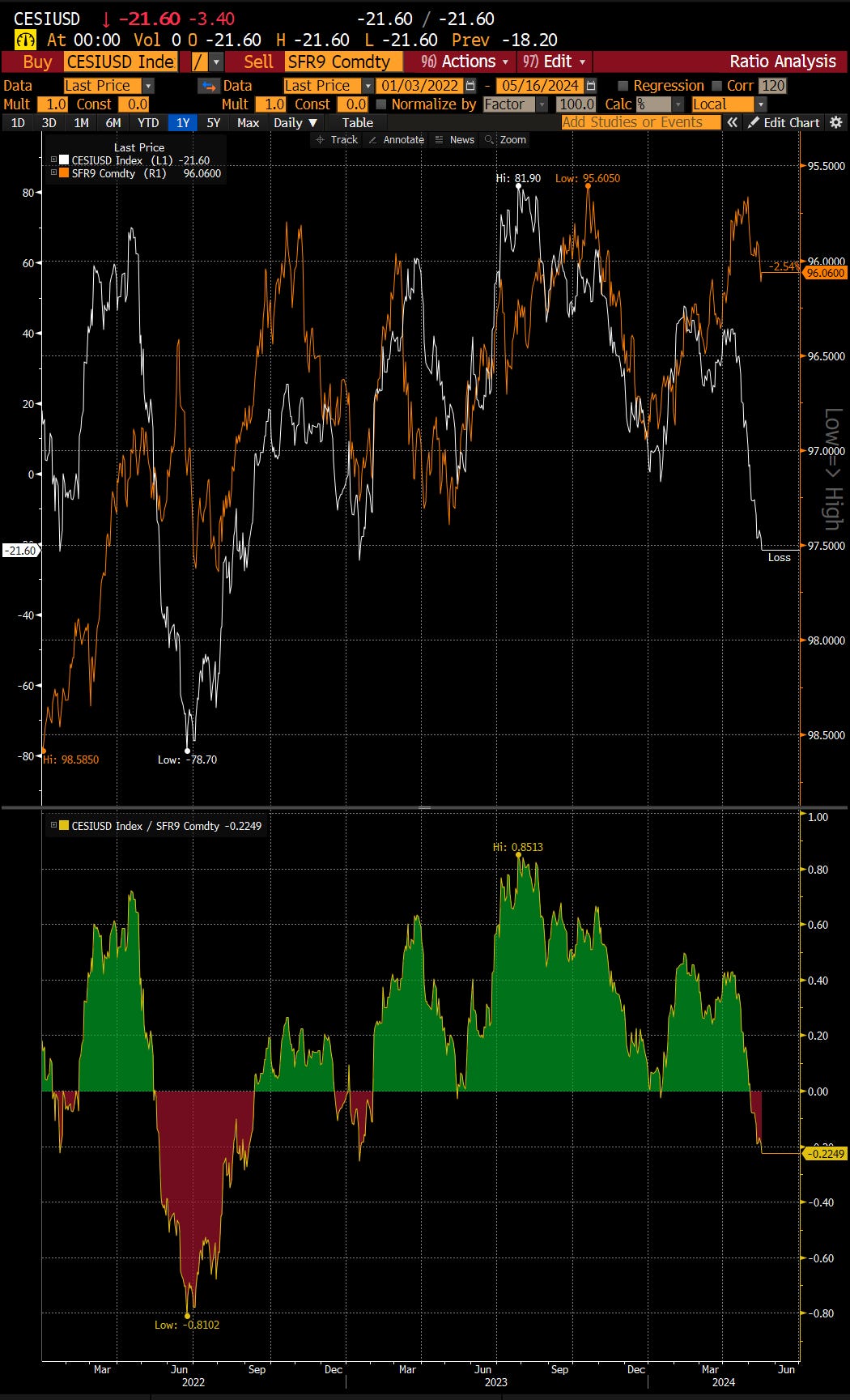

Citi Surprise Index vs SFR9: Economic data surprises are rolling over hard but the Fed is trapped because of sticky inflation. Inability to provide accommodation to an economy rolling over is risk off

Trigger Warning: Chart of the Day: Citi Surprise Index vs SFR9 (proxy for federal funds rate 9 months forward)

Source: Bloomberg

My hypothesis is that the US economy has begun to slow due to the long and variable lags of monetary policy finally starting to offset the positive benefits that have come from higher government deficits putting interest expense "stimmys" into the hands of households and corporations that have locked in low cost borrowings executed during the depths of Covid.

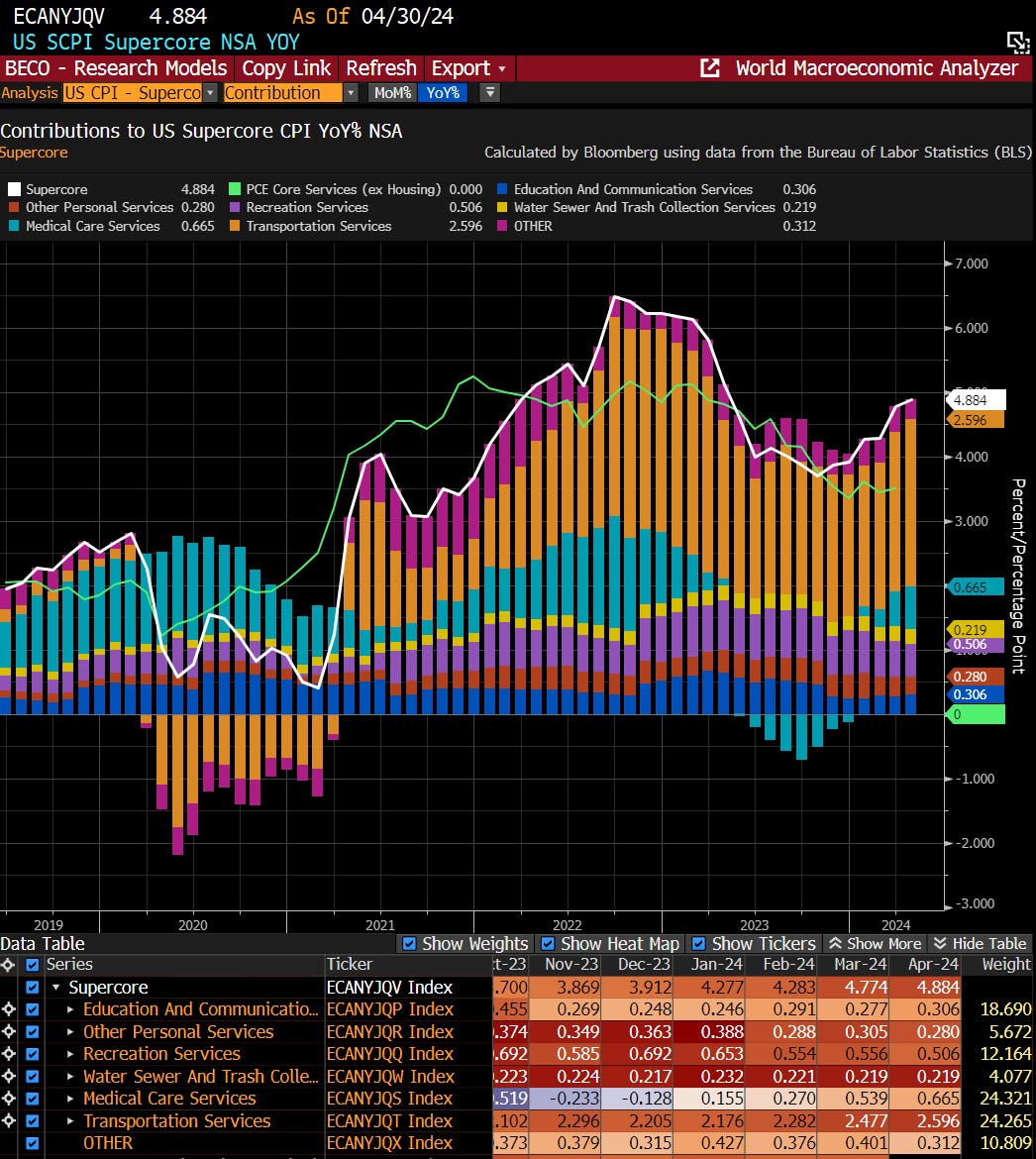

So the economy is starting to roll over and certainly is faltering against elevated expectations (hence Citi surprise breakdown). However, because of the sticky inflation which was confirmed again this week with supercore CPI running 4.9% yoy (chart below) and what is looking like an April core PCE which is likely to come in near 0.3% mom, the Fed is really in no position to address the slowdown in growth with more accommodation because the economy is not on any sustainable path back to 2% inflation.

Source: Bloomberg, BLS

Keep reading with a 7-day free trial

Subscribe to The Alethea Narrative to keep reading this post and get 7 days of free access to the full post archives.